US pharma should be profiting tremendously from the newly discovered vaccine that will end the pandemic. While that appeared to make sense at first, a look at share prices shows the industry is not doing so well. Take, as an example, the firm who invented the first Covid-19 vaccine: Pfizer. It was at the forefront of the race to develop it, and in the process, ended up finding a new technology altogether. But that has not led to higher share prices. A few research firms upped their projections, but soon after the initial euphoria, Pfizer released “lower than expected” dividends. Analysts followed suit and reduced share price expectations. The consensus target price was set between US$ 38 and US$ 40.

We believe that, although Pfizer may eventually profit from these new technologies, the firm won’t be able to translate that into short term profit. New products will have to follow the R&D patent cycle to potentially generate value. As a result, we agree with the market consensus at a US$ 40 target share price.

US pharma leads the world in R&D and market share – US pharma is expected to reach US$ 685 billion by 2023 1 . It represents 40% of the global market, whose expected size should reach US$ 2.1 trillion by 2027 2 . The US also leads in R&D, which helps explain the industry’s incredible 74.8% growth experienced since 2019, when it amounted to merely US$ 1.2 Trillion. To put it in perspective, pharma is big, especially compared to the overall US economy: it accounts for 13.1% of the S&P 500 3 . But COVID-19 really hurt the industry: while it had grown by 18.7% in 2019, it only grew 11.4% in 2020. Hence, dividends dwindled, earnings forecasts were downgraded, and markets lowered their share price consensus.

Pharma R&D pandemic shift – For the past decade, pharma R&D spending was primarily channeled to “chronic diseases and untreatable disorders,” i.e., developed countries’ diseases, 4 where drug R&D can be fully charged back to consumers. In developing countries, generics and widespread copyright infringements make it hard to earn back the R&D investment. Since COVID-19, pharma industry has changed, and R&D has shifted from chronic diseases to a laser focus on the coronavirus. 5 The fact that many new drugs’ trials were cancelled due to mobility restrictions made this shift even more radical than originally expected.

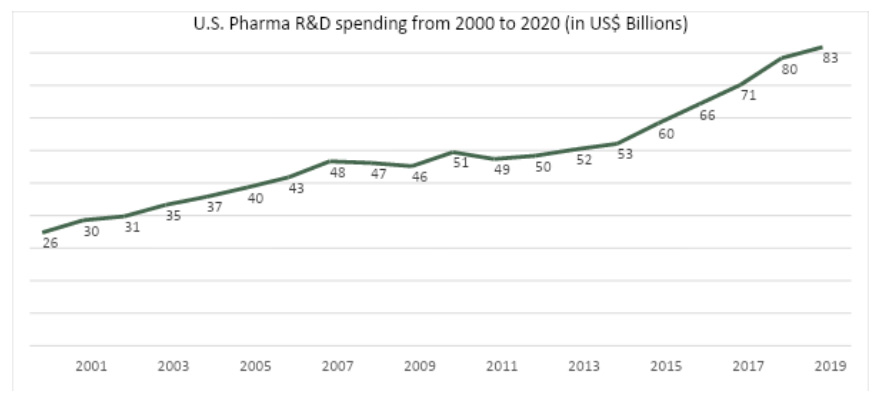

VC fuels US pharma R&D growth – The partnership between venture capital firms and pharma has fueled much of the US R&D investment over the years. As illustrated in the chart below, R&D spending went from US$ 26 billion in 2000 to US$ 83 billion by 2019, a 219% surge. In 2020 alone, it grew by 20% to US$ 100 Billion. But analysts continue bearing in the short term.

Source: Statista – * Estimated from 2010 to 2019

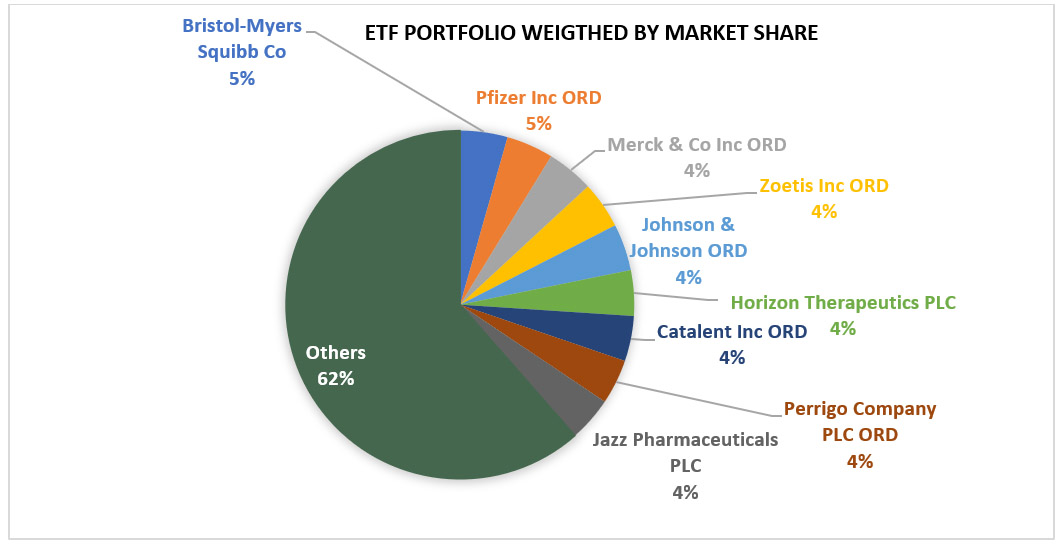

An ETF that mimics pharma sector performance – SPDR S&P Pharma ETF (XPH) portfolio is an ETF with a highly distributed portfolio proportional to each company’s market share, as displayed in the chart below:

Source: Yahoo Finance

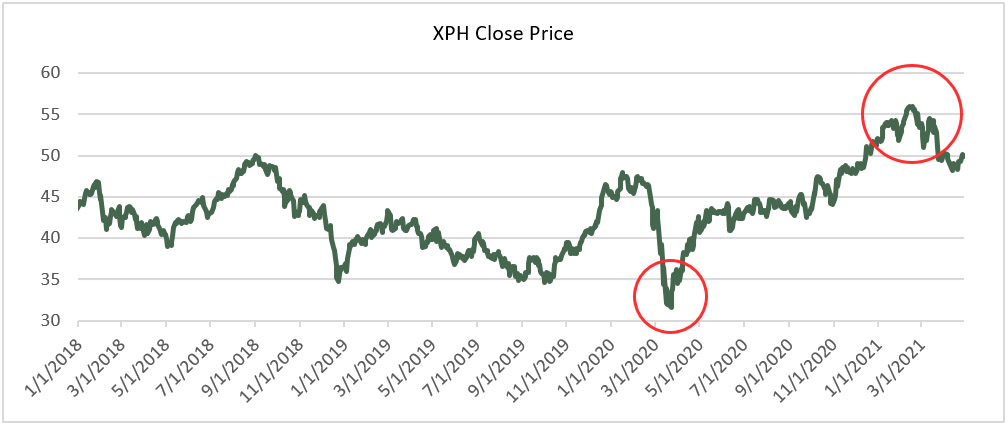

ETF as a market proxy for its volatility – We will use this ETF as a proxy for sector performance to explain what happened in pharma over the past three years. At the beginning of the pandemic, as everyone else, the sector suffered from the initial panic. After all, many companies had to postpone clinical trials and reorganize their R&D efforts to develop a COVID-19 vaccine. This initial panic is indicated by the first red circle on the graph below. As vaccine trials became successful and shots were distributed to the population, pharma experienced an all-time high in February of 2021 (second red circle), only to come down in the next months, as illustrated in the graph below:

Source: XPH fund information: retrieved on April 29, 2021

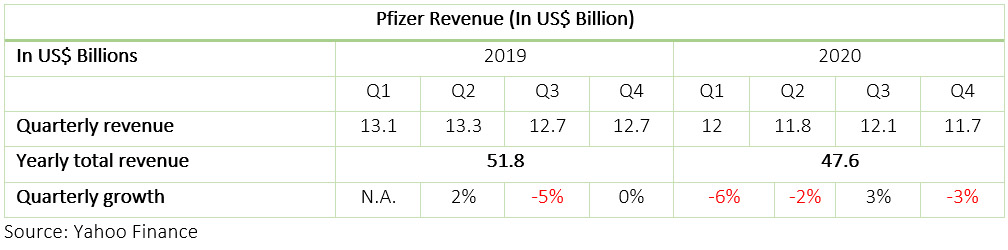

Weak Pharma Revenue – pharma share prices were subdued, indicating that fundamentals were still considered weak, and vaccines’ expected cash flows should not match pandemic losses. It affected pharma’s top and bottom line. As one can see in the table, even when revenue grew in Q3 2020, it was still far below 2019. This shows how brutal COVID-19’s impact was on pharma, regardless of its expected profits from vaccine sales.

Pfizer and its new focus on its heritage – In 2019, Pfizer welcomed its new CEO, Albert Bourla, whose goal was to take Pfizer back to its origins as a purely bio-pharma company. With this renewed enthusiasm, Pfizer joined forces with BioNTech during the race to develop a Covid-19 vaccine in record time. In December 2020, the company’s vaccine was the first approved for emergency use to fight the pandemic.

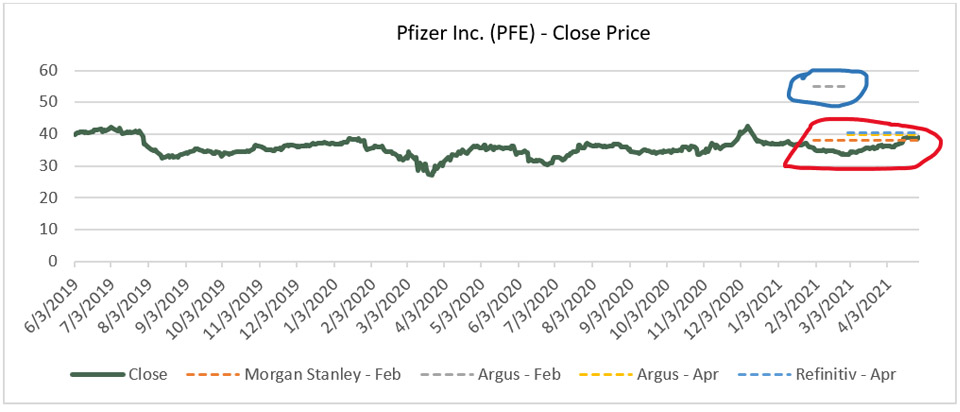

A look at forecasts for Pfizer’s stock price – As displayed in the graph below, the Pfizer stock has been trading between US$ 27 and US$ 43 for the last three years. It reached its lowest point in March 2020, when the pandemic scare reached the markets. As of February 2021, Argus’s team was overly optimistic about the future of the company. Argus believed that the newly developed mRNA platform could sustainably boost future revenues, and it then set a target price of US$ 55 per share. This optimism did not last long, however, as its April report brought prices back to US$ 40.

This change occurred mainly because Viatris (Upjohn), a spin-off completed in November 2020, paid dividends below market consensus. As Pfizer management is expected to reduce its own dividend proportionally to what it would obtain from Upjohn spin off, analysts predict that the dividend will lower to $1.52 per stock, a $0.04 difference from the previously expected $1.56 per share. So besides weak revenue seen on the table above, the bottom line was also affected, which led to further downgrading of this share.

Source: Yahoo Finance

Pfizer stock forecast – The graph above shows Pfizer stock forecasts. After Argus’s team downgraded its original forecast (blue circle) to US$ 40 per share, its prediction became much more aligned with those of other analysts. Refinitiv analysts, for instance, priced the shares at US$ 40.50. Morgan Stanley was a bit more bearish due to Pfizer’s dividends and the current macro scenario, so it set its target price at US$ 38 per share. We believe that the new technologies developed by Pfizer may in fact bring new types of revenue for the company, so we are a bit more bullish than Morgan Stanley.

This new mRNA technology can be expanded for use in cancer therapies, and Pfizer is already developing booster shots. Plus, the stock price has already been at US$ 38 since April. Thus, since the economy is expected to grow after the Covid-19 scare, we believe that US$ 40 is a realistic target price based on the predominant market consensus.

Bernardo Weaver is a senior finance consultant at the World Bank Group in Washington DC and a finance professor to top investment banks and Hedge Funds in Wall Street. Mr. Weaver also teaches M&A as an adjunct professor at Georgetown McDonough School of Business and at Pepperdine University Graziadio School of Business. Mr. Weaver is a Wharton MBA grad, and holds an LLM from UConn Law, and a law degree from P.U.C.- Rio, in Brazil.

Bernardo Weaver is a senior finance consultant at the World Bank Group in Washington DC and a finance professor to top investment banks and Hedge Funds in Wall Street. Mr. Weaver also teaches M&A as an adjunct professor at Georgetown McDonough School of Business and at Pepperdine University Graziadio School of Business. Mr. Weaver is a Wharton MBA grad, and holds an LLM from UConn Law, and a law degree from P.U.C.- Rio, in Brazil.**Disclaimer**

This article was prepared exclusively for Blaylock Van, LLC. Links are solely intended for convenience and are not intended to be advertisement whatsoever. Linked sites are not under the control of Blaylock Van, LLC and Blaylock Van, LLC is not responsible for the content of any linked site or any link contained in this article. Blaylock Van, LLC does not endorse companies, or their products or services, to which it links. If you decide to access any of the third-party sites linked to this site or article, you do this entirely at your own risk. This document is confidential and has been prepared for informational purposes only. This document is not to be construed as a recommendation, an offer to sell or a solicitation of an offer to buy any securities. Any dissemination, distribution or reproduction of this document is strictly prohibited without the consent of Blaylock Van, LLC. The information herein is obtained from sources deemed reliable, but its accuracy and completeness cannot be guaranteed, and is subject to change without notice.

_______

1 U.S. Pharmaceuticals Industry Analysis and Trends 2023. (n.d.). Retrieved April 29, 2021, from https://www.reportlinker.com/p05761205/U-S-Pharmaceuticals-Industry-Analysis-and-Trends.html?utm_source=GNW

2 Fortune Business Insights

3 Argus, Pfizer Inc Report (2021, February 11).

4 Impact of covid-19 on Pharma market size, share & industry analysis, by TYPE (Drugs (Prescription drugs and OTC Drugs), Vaccines), by Indication (anti-viral, Anti-infective, Anti-hypertensive, Oncology, respiratory Disease, CARDIOVASCULAR Disorders, neurology Disorders, diabetes, and others) by distribution Channel (Hospital PHARMACIES, retail pharmacies, and Online PHARMACIES), and Regional Forecast, 2020-2027. (n.d.). Retrieved April 28, 2021, from https://www.fortunebusinessinsights.com/impact-of-covid-19-on-pharmaceuticals-market-102685

5 See footnote 4

6 Chopoorian, R., & Gross, D. (2021, February 04). Pfizer’s vaccine MACHINE. Retrieved April 27, 2021, from https://www.strategy-business.com/article/Pfizers-vaccine-machine?gko=b14b0